Ephemeral Messaging in Finance: Secure Communication for Financial Institutions

Introduction: The Communication Challenge in Financial Services

Financial institutions face a unique challenge: they must protect highly sensitive financial data while facilitating efficient communication both internally and with clients. Simultaneously, they must navigate complex regulatory requirements that govern data retention, privacy, and security.

In this high-stakes environment, traditional communication methods often fall short. Standard emails create permanent records that could be compromised, while messaging platforms without proper security controls expose financial institutions to significant risks. This is where ephemeral messaging—communications that automatically disappear after being read—presents a compelling solution for certain types of financial information exchange.

Understanding the Financial Security Landscape

Key Challenges in Financial Communication Security

- Regulatory Compliance: Financial institutions must comply with regulations like GDPR, CCPA, GLBA, and industry-specific requirements that govern data protection and privacy.

- Data Breach Risks: Financial data is particularly valuable to attackers, making financial institutions prime targets for sophisticated cyber attacks.

- Client Confidentiality: Maintaining client trust requires absolute confidentiality for sensitive financial information.

- Record Retention Policies: Financial institutions must balance security needs with regulatory requirements for specific record retention periods.

- Insider Threats: Internal staff with access to sensitive communications represent a significant security consideration.

The Role of Ephemeral Messaging in Financial Security

Ephemeral messaging, including self-destructing notes technology like Privnote, offers several key advantages for financial institutions:

1. Reduced Data Persistence Risk

By automatically deleting messages after they've been read, ephemeral messaging significantly reduces the risk window associated with sensitive financial data. This "read-once" approach means that even if systems are later compromised, the sensitive information is no longer available to attackers.

2. Controlled Information Sharing

Financial advisors, wealth managers, and banking professionals can share time-sensitive information (like one-time passwords, temporary access credentials, or transaction details) without creating permanent records that could later be compromised.

3. Complementing Existing Security Infrastructure

Ephemeral messaging isn't meant to replace existing secure communication channels but rather to complement them for specific use cases where information should not persist indefinitely.

Use Cases for Ephemeral Messaging in Financial Services

1. Secure Credential Sharing

When financial institutions need to provide clients with temporary access credentials, login information, or one-time passwords, ephemeral messaging ensures this information disappears after use, eliminating the risk of these credentials remaining in email inboxes indefinitely.

2. Time-Sensitive Transaction Details

For high-value transactions or wire transfers that require verification, ephemeral messages can securely communicate sensitive details that should not be permanently stored in standard communication channels.

3. Private Client Communications

Wealth managers and private bankers handling ultra-high-net-worth clients can use ephemeral messaging for discussions about sensitive investment opportunities, account details, or financial strategies that require exceptional confidentiality.

4. Merger and Acquisition Discussions

During M&A activities, financial institutions can use ephemeral messaging for preliminary discussions containing sensitive market information that should not be permanently recorded until appropriate stages of the process.

5. Internal Security Communications

Security teams can use ephemeral messaging to communicate about potential vulnerabilities, security incidents, or sensitive internal matters without creating permanent records that could themselves become security risks.

Regulatory Considerations and Compliance

While ephemeral messaging offers security benefits, financial institutions must carefully navigate regulatory requirements:

Balancing Ephemeral Communications with Record Retention Requirements

Financial institutions operate under various regulations that mandate specific record retention periods. To successfully implement ephemeral messaging while maintaining compliance, organizations should:

- Develop Clear Policies: Create comprehensive guidelines specifying what types of information can be shared via ephemeral messaging versus what must be retained in official record-keeping systems.

- Documentation Practices: Establish procedures for documenting that ephemeral communications occurred, even if the content itself is not preserved. This metadata can satisfy certain regulatory requirements while maintaining the security benefits of ephemeral messaging.

- Training and Governance: Ensure all staff understand when to use ephemeral messaging and when to use channels that create permanent records.

Specific Regulatory Frameworks

Financial institutions should consider these key regulations when implementing ephemeral messaging:

- SEC Rule 17a-4: Broker-dealers must preserve records of communications that lead to transactions. While ephemeral messaging may be appropriate for preliminary discussions, communications that directly influence transactions generally need to be preserved.

- FINRA Regulatory Notice 17-18: Provides guidance on the use of electronic communications and recordkeeping requirements for financial firms.

- GDPR and CCPA: Privacy regulations may actually favor ephemeral messaging in some contexts, as they promote data minimization principles.

Implementing Ephemeral Messaging in Financial Institutions

Best Practices for Implementation

- Risk Assessment: Conduct a thorough assessment of your communication needs, identifying specific use cases where ephemeral messaging adds security value without compromising regulatory compliance.

- Policy Development: Create comprehensive policies governing when and how ephemeral messaging should be used, including clear guidelines on what types of information are appropriate for this channel.

- Staff Training: Ensure all employees understand both the benefits and limitations of ephemeral messaging, along with their responsibilities for proper use.

- Technical Implementation: Select secure ephemeral messaging solutions that offer appropriate security controls, including encryption, access controls, and proper message destruction mechanisms.

- Audit Capabilities: Even with ephemeral content, maintain audit logs that record metadata about communications (such as sender, recipient, time, and general purpose) without preserving the sensitive content itself.

- Regular Review: Periodically review ephemeral messaging practices to ensure they remain aligned with evolving regulatory requirements and security best practices.

Integration with Existing Security Controls

Ephemeral messaging should be integrated into your broader security infrastructure:

- Multi-factor Authentication: Ensure access to ephemeral messaging platforms requires strong authentication.

- Data Loss Prevention: Integrate with DLP solutions to prevent inappropriate sharing of certain information types.

- Security Awareness: Include ephemeral messaging in security awareness training programs.

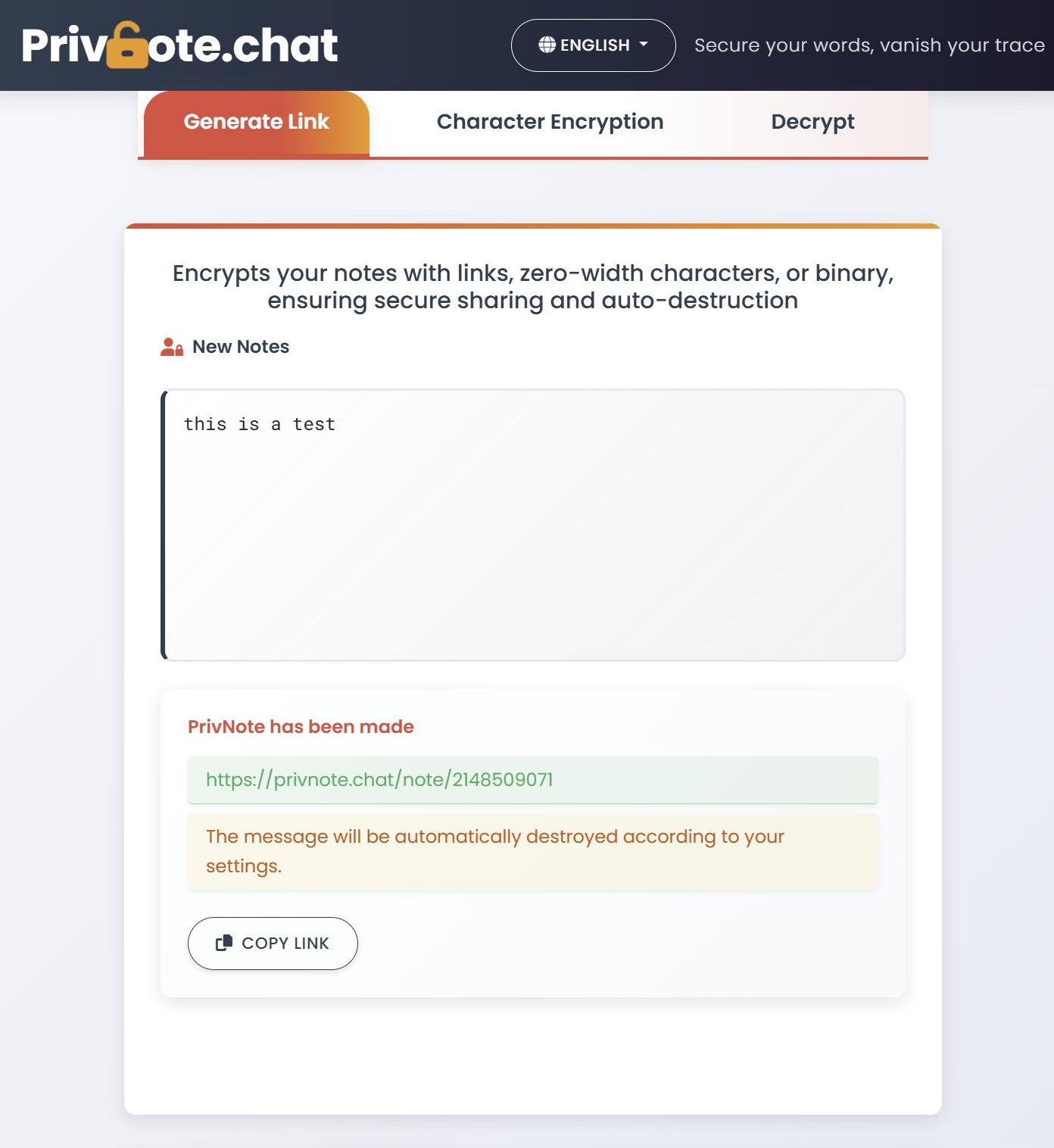

Privnote in Financial Services: A Practical Solution

Privnote offers financial institutions a simple yet effective ephemeral messaging solution that can be implemented without significant technical overhead:

Key Features for Financial Use

- Self-Destructing Notes: Messages that automatically delete after being read, leaving no persistent copies.

- Password Protection: Additional security layer requiring recipients to enter a password to access sensitive information.

- No Account Requirements: Eliminates the security risks associated with account management while allowing immediate secure communication.

- Encrypted Transmission: All communications are encrypted in transit, protecting sensitive financial data.

- Reference Numbers: Allows notification of message availability without exposing actual content in alerts.

Implementation Scenarios

Financial institutions can implement Privnote in various ways:

- Client Onboarding: Securely share initial access credentials during the onboarding process.

- Transaction Verification: Confirm transaction details through a separate, secure channel that doesn't leave persistent records.

- Password Resets: Provide temporary access codes for account recovery without creating permanent email records.

- Private Banking Communication: Share sensitive account information with high-value clients when needed.

Future Trends in Financial Communication Security

The landscape of secure communications in financial services continues to evolve:

Emerging Technologies

- Blockchain for Audit Trails: Using blockchain to create immutable audit trails of ephemeral communications metadata while still allowing the content itself to be deleted.

- AI-Powered Security: Artificial intelligence systems that help determine what information should be communicated through ephemeral versus permanent channels.

- Biometric Authentication: Enhanced security for accessing ephemeral messages through biometric verification.

Regulatory Evolution

As financial regulations continue to evolve, we're likely to see more specific guidance on the appropriate use of ephemeral messaging in financial contexts, potentially including:

- Clearer guidelines on what types of communications must be preserved versus what can be ephemeral

- Standards for metadata retention when content itself is ephemeral

- Technical requirements for secure ephemeral messaging platforms in regulated industries

Conclusion: The Strategic Value of Ephemeral Messaging

For financial institutions navigating the complex landscape of data security, regulatory compliance, and efficient communication, ephemeral messaging represents a valuable addition to the security toolkit. When implemented thoughtfully with clear policies and appropriate use cases, solutions like Privnote can significantly enhance security posture by reducing the persistence of sensitive financial information.

The key to success lies in strategic implementation: understanding when ephemeral communications are appropriate, establishing clear governance around their use, and integrating them into a comprehensive security strategy that balances protection with compliance.

By adopting ephemeral messaging as part of a layered approach to communication security, financial institutions can better protect their most sensitive information while maintaining the operational efficiency needed in today's fast-paced financial environment.